We live in a fantasy world, a world of illusion. The great task in life is to find reality.”

But given the state of the world, is it wise?”

― Iris Murdoch

The general consensus with economists for years has been that all else equal, (or ceteris paribus in economics lingo) higher Central Bank Independence (CBI) should lead to lower rates of inflation and greater price stability. That assumption rests on an important factor that perhaps many of us take for granted in the West-the validity of the rule of law. The whole notion of legal, or de jure, independence argues that the institutions established prolongate laws as the supreme ruling force of the land, and to amend these laws there is an established arduous process through legal frameworks. Yet, as with every rule, there are exceptions.

Throughout the many weeks I was immersed in the works of Stanley Fischer and Alex Cukierman about central banking, their overarching concepts and results seemed straightforward to me. As I ran over the data over and over again, the trend held strong. Those countries with higher CBI were correlated with lower inflation. Of course, there were ambiguities within the data and periods of time when global inflation pushed prices up, but the overall trend was strong. Perhaps due more to my naivety and lack of experience, the issue seemed black or white.

One day, I ran across an irregularity. A situation where both could be true-high CBI and higher rates of inflation (as of 2023, Turkey’s inflation reading was near 53%). A real-world situation of the grey. The Republic of Turkey’s economy presented a case where the lines between reality and illusion blur, making the case of its Central Bank as elusive as the mists of the Bosporus Strait in the very heart of its capital of Istanbul. The unpredictable story of its Central Bank begins in the wake of the 2001 Turkish Financial Crisis.

How the Central Bank Got Its Independence Overnight.

In an article written by W. Robert Pearson, former Executive Secretary of the Department of State and former United States Ambassador to Turkey, he details the Turkish 2001 Financial Crisis, recalling vividly

“On February 19, 2001, at a formal government meeting, the president of Türkiye, Ahmet Necdet Sezer, accused the prime minister, Bulent Ecevit, of incompetent management of the country’s banking system and threw a copy of the Turkish constitutional code book across the table at him. The prime minister stormed out, called a press conference, and verbally attacked the president. Immediately, the stock market panicked, the lira plunged, and interest rates skyrocketed.” 2

Following this dramatic exchange, the responsibility of pulling the country out of the financial crisis fell on the shoulders of the Central Bank of Turkey. The government banded together and passed historic legislation known as The Law on the Central Bank of the Republic of Turkey (CBRT) No.4651 which revamped the framework of the Central Bank. The main amendments of the law included price stability as the sole objective, prohibiting financing government debt, and the creation of a decision-making monetary policy council, known as the Monetary Policy Committee (MPC), with full discretion to use monetary policy tools to fulfill their mandate. (For further information, I have listed the link to the CBRT’s website that expands on these amendments in more detail: http://TCMB – Central Bank Monetary Policy Framework).

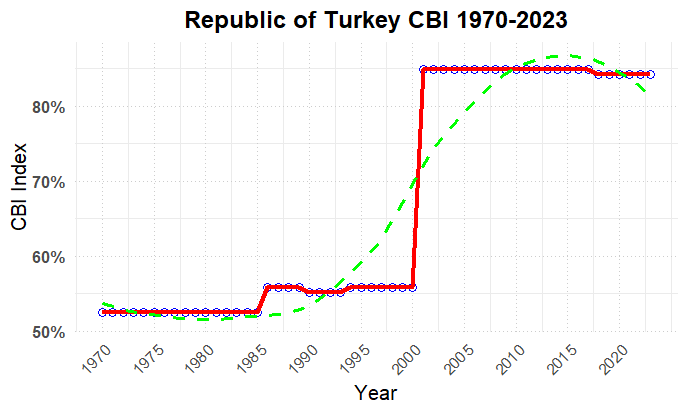

Overnight, we saw how the Central Bank of Turkey gained unprecedented levels of independence. Utilizing data from Davide Romelli’s CBI Index, I constructed a time-series graph that shows how CBRT’s independence changed over time. The red line shows the change in CBRT’s independence over time, meanwhile the dashed green line smooths out the volatility in the data using the LOESS (Locally Estimated Scatterplot Smoothing) method.

Figure 1:

The data shows that the year 2001 was monumental for central banking in Turkey. It brought their independence rating to one of the highest in the entire world, and despite a small decrease in 2018, it retains its high world ranking. However, increased independence did not bring about the desired end to inflation as aspired.

Is There More to the Story?

If it isn’t legal independence inhibiting the central bank from maintaining lower rates of inflation and price stability, what other factors could it be?

Carola Binder, non-resident fellow at the Hutchins Center on Fiscal and Monetary Policy, developed the concept of de facto independence. The notion of de facto independence observes if a central bank can resist pressure (pressure is defined as any recommendation or communication from a government official to a central bank regarding a course of action for monetary policy) from the government to make independent unbiased decisions in practice. In her journal article De Facto and De Jure Central Bank Independence (2020), she quotes American economist Kenneth Rogoff,

“With the global rise of populism and autocracy, central-bank independence is under threat, even in advanced economies… Recently, however, an increasing number of politicians believe that it is high time to subordinate central banks to the prerogatives of elected officials…” (Rogoff, 2019)3.

This keen observation shows that with governments expanding in size, many politicians have discarded concern over statutory regulations and are not meticulous about glossing over laws to lobby central banks to do their bidding. Binder constructed a quarterly dataset of 118 central banks that faced pressure between 2010-2019 in her article Political Pressure on Central Banks.

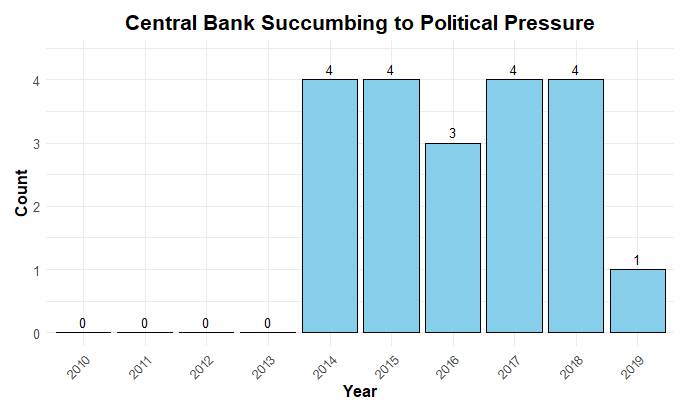

Utilizing her database, I constructed a time series graph that demonstrates all the recorded instances that the CBRT has been pressured in any way regarding monetary policy decisions.

Figure 2:

I demonstrate using her data that up until 2013, the high de jure level of independence shielded the CBRT from any governmental pressure. However, from 2014-2018, we suddenly see an onslaught of governmental pressure on the central bank. Instances averaged to once a quarter, a high number compared with instances observed with other central banks.

Was the Central Bank Able to Resist Pressure?

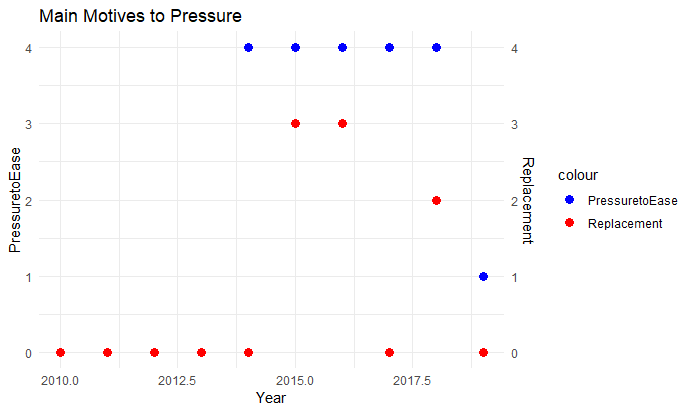

Unfortunately, no. Below is a time series bar graph that I created utilizing the same dataset that shows that, despite planting its foot strong in 2013, the Central Bank of Turkey has succumbed to governmental pressure in almost every instance.

Figure 3:

What are some of the main motives behind the constant governmental pressure? Perhaps the government understands the necessary actions to stabilize the economy, and pressures the MPC to stick to their sole objective of price stability?

Unfortunately, no; again. The data shows there has been two main motivations that have set the grounds for the Turkish government to pressure the CBRT. The main motive has been to pressure the Central Bank to ease monetary policy to stimulate the economy above its sustainable levels, while the other main motive being replacement, or threatening to replace the current governor of the central bank due to dissatisfaction with their policy decisions.

Below is a visual that captures the frequency of the two main motives across time.

Figure 4:

The dynamic story of the Central Bank of Turkey started on concrete foundations. The revamped framework and granted independence seemed to be the blueprint of success that countless real-life scenarios had shown to be true. Yet, the degradation of legislation and the sheer brute power of government intervention displayed that, despite the strong pillar of law holding up the Central Bank, other factors can override its independence. Perhaps the story of the Central Bank of Turkey is not over, and as the elusive mists of the Bosporus Strait, it can take an unforeseeable change of course for the better.

Appendix:

- Featured Image for this article was generated by ChatGPT. Citation: OpenAI. (2024). Central Bank of Turkey Resisting Government Pressure (generated by ChatGPT). Retrieved from OpenAI’s ChatGPT.

- Pearson, W. Robert. “CPR for the Turkish Economy: The 2001 Financial Crisis and Its Aftermath.” Edited by Raymond F Smith , American Diplomacy , Feb. 2024, americandiplomacy.web.unc.edu/2024/02/cpr-for-the-turkish-economy-the-2001-financial-crisis-and-its-aftermath/.

- Binder, C. (2020). 10. DE FACTO AND DE JURE CENTRAL BANK INDEPENDENCE. Populism, Economic Policies and Central Banking, 129.

Leave a comment