“Democracy is a slow process of stumbling to the right decision instead of going straight forward to the wrong one.” – Anonymous

Over the course of the last two months, the importance of central bank independence (CBI) has arisen once again. The Bank of Thailand has stood strong against government pressure to ease monetary policy to spur growth in a struggling economy. The Pattaya Mail highlights this ongoing conflict between the central bank and the government:

“Bank of Thailand (BOT) Governor Sethaput Suthiwartnarueput has stressed the importance of central bank independence in setting monetary policy amid ongoing disagreements with the government over interest rates. While the government has advocated for rate cuts to stimulate short-term growth, the BOT has held firm, arguing that such moves could risk long-term stability by increasing inflation and debt vulnerabilities.1”

The post-pandemic era introduced new challenges for monetary policy globally, as central banks strive to engineer a “soft landing” while laying the foundation for sustainable growth. This challenge has been complicated by never-ending political pressure to compensate for any lost economic growth. The case of the Bank of Thailand has not escaped international attention, with Reuters commenting on the BOT’s recent decision to cut rates, “The 25-basis-point reduction was the first rate cut since May 2020, following five consecutive meetings where it held rates steady and months of pressure from the government, looking to the central bank for help with reviving sluggish growth.2”

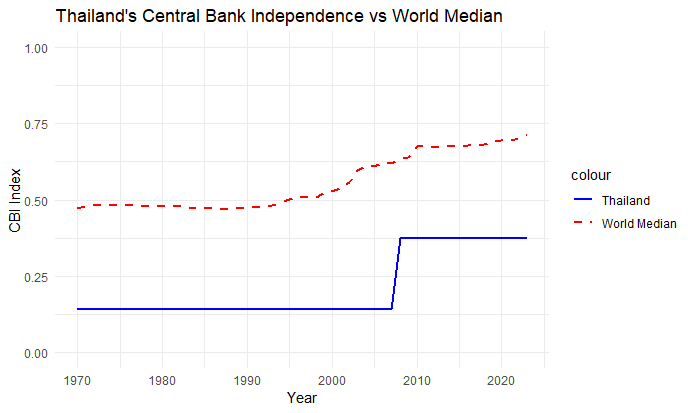

Historically, central banks with higher de jure, or statutory, independence are more prone to resisting government pressure since their independence is inscribed in law, guaranteeing either policy or instrumental independence. However, when examining the case of BoT, the data shows something counterintuitive. Despite their strong resistance against government pressure, their CBI index falls considerably below the world median. Using Romelli’s CBIE index, I plot legal independence of the Bank of Thailand in comparison to the world median across time.

Figure 1:

Given their lower CBI score, it is all the more commendable of their brave stance against government pressure meddling in central bank activities.

The BoT has fought an uphill battle in gaining legal independence after losing credibility in the 1997 Asian Financial Crisis and the attempt to regulate capital inflows which appreciated the Baht and hurt exports in 2006 with largely controversial capital controls (a prime example of Mundell’s impossible trinity of fixed exchange rates, capital inflows, and independent monetary policy). The BoT’s mismanagement of both monetary policy challenges hurt their case to convince the National Legislature to grant them statutory independence. Former Minister of Finance Sussangkarm states also that their premature exit from the IMF 1997 Program also hurt the Bank’s chances of structural reform. He states “Thailand exited the IMF program and its conditionality fairly quickly (in September 1999) as there was a quick turnaround in the foreign reserves position and Thailand no longer needed additional drawings from the IMF package. If Thailand had stayed longer, then many new laws would have been passed during that time as part of the IMF structural reform programs.3”

Finally, in 2008, the long-awaited reforms happened to the Bank of Thailand Act of 1942. Breaking down the components of the CBIE index, Figure 2 shows which components saw the biggest increases due to the amendments.

Figure 2:

The creation of a monetary policy objective of an inflation target, more structured debt management and financial independence, and Board appointment reforms drove the index up.

The Federal Reserve Bank of Minneapolis comments on the structure of the Bank of Thailand:

“The Minister of Finance is empowered to oversee the overall affairs of the Bank, with general control and direction entrusted to a court of directors, comprised of the governor and deputy governors, appointed by His Majesty the King as chairman and vice chairmen respectively, and at least five assistant governors appointed by the Cabinet.4”

Has Government Pressure Always Been Prevalent?

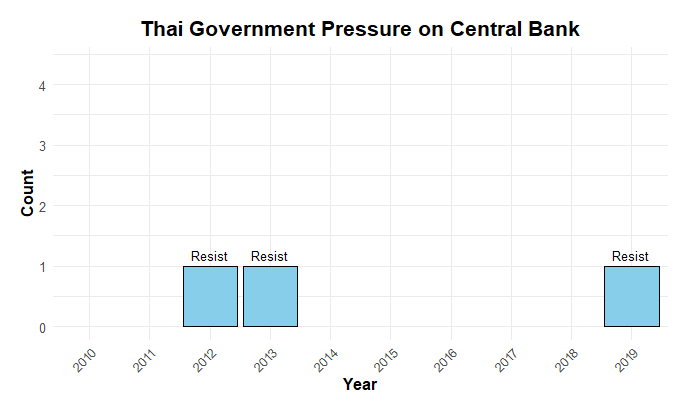

Despite the low independence of the central bank, the government has not made it a habit to pressure the Bank to change monetary policy decisions. Furthermore, in all cases where the government had pressured the central bank to alter their monetary policy stance, the central bank has resisted. Using Carolina Binder’s De Facto Independence data, I plot all the recorded the times last decade when the BoT has been pressured. Figure 3 shows government pressure on the BoT and the BoT’s strong resistance.

Figure 3:

What is the Relationship Between Government and Central Banks?

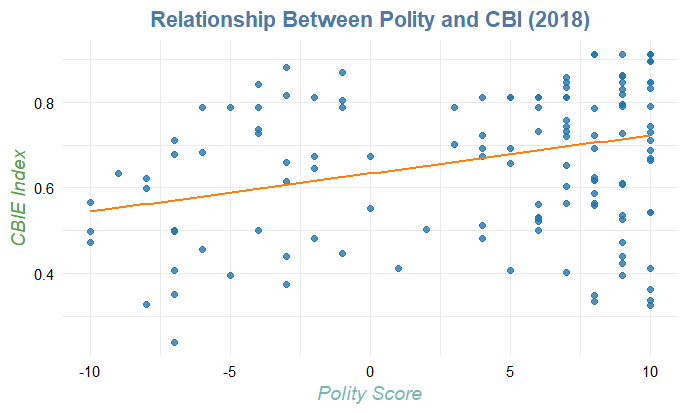

The relationship between Central Banks and Government has been a complex tango, with short-term government interests conflicting with the far-sighted central bank policies. However, thanks to research by Crowe and Meade (2007) and Cukerimann, Webb, and Neyapti (1992), evidence shows that more democratic nations will accept inflation reform and grant central banks more independence to pursue monetary policy objectives. By plotting a simple linear regression, I observe the relationship between CBI and Polity score. Figure 4 demonstrates the result.

Figure 4:

The Polity Score is a 21-point scale ranging from -10 (hereditary monarchy) to +10 (consolidated democracy) for political regime analysis that follows close to 180 countries from 1800 to 2018. The results of my linear model show that there is a positive relationship between more democratic countries granting their central banks higher legal independence.

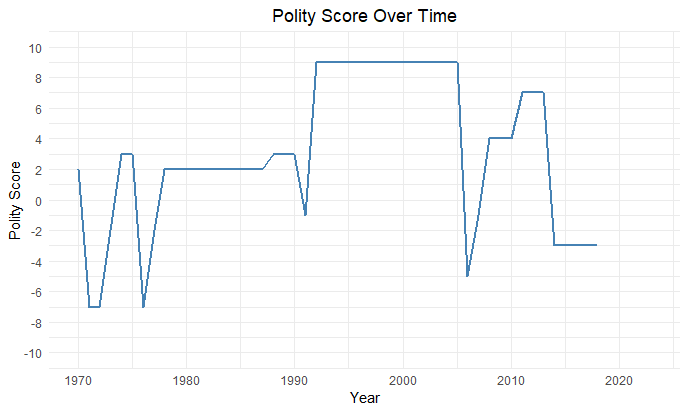

However, the government of Thailand has experienced many structural shifts, coups, and temporary governments that led to a very volatile Polity Score from 1970-2018. Figure 5 shows the volatility of the government structure due to regime changes.

Figure 5:

It is important to note that the 2008 reforms came during a period of Thailand’s history where the country was enjoying a relative high democracy level and was continuing to move towards a consolidated democracy.

The recent resilience of the Bank of Thailand against government pressure brought to light that the conversation of central bank independence from government intervention is far from over and underscores its importance for a nation’s well-being. Despite having little legal protection, the Bank of Thailand stood strong in the face of government pressure as it continues to guide Thailand’s economy to a path of sustainable growth.

Works Cited:

- “BOT Governor Defends Rate Policy amid Govt Pressure.” Thailand Business News, 23 Sept. 2024, http://www.thailand-business-news.com/banking/163885-bot-governor-defends-rate-policy-amid-govt-pressure.

- “BOT Governor Defends Rate Policy amid Govt Pressure.” Thailand Business News, 23 Sept. 2024, http://www.thailand-business-news.com/banking/163885-bot-governor-defends-rate-policy-amid-govt-pressure.

- Sussangkarn, Chalongphob. (2017). The Bank of Thailand Act 2008 and Central Bank Independence. 10.13140/RG.2.2.34612.96645.

- “The Bank of Thailand: Federal Reserve Bank of Minneapolis.” Federal Reserve Bank of Minneapolis: Pursuing an Economy That Works for All of Us., http://www.minneapolisfed.org/article/1998/the-bank-of-thailand. Accessed 19 Oct. 2024.

Appendix:

- BANK OF THAILAND ACT – Final (bot.or.th)

- Crowe, Christopher, and Ellen E. Meade. “2007-20 Central bank independence and transparency.” (2007).

- Cukierman, Alex, Steven Webb, and Bilin Neyapti (1992). “Measuring the Independence of Central Banks and Its Effect on Policy Outcomes”.

Leave a comment